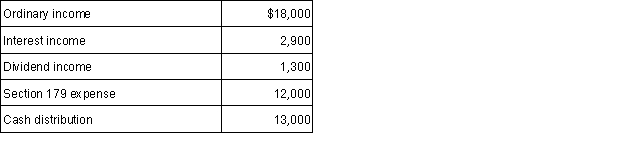

Partner Tami (a 20% partner) had the following items reported to her on a partnership Schedule K-1:  Tami had a basis in her partnership interest of $14,000 at the beginning of the year. Additionally, the partnership has recourse liabilities of $100,000 outstanding at the end of the year. What is Tami's basis in her partnership interest at the end of the year?

Tami had a basis in her partnership interest of $14,000 at the beginning of the year. Additionally, the partnership has recourse liabilities of $100,000 outstanding at the end of the year. What is Tami's basis in her partnership interest at the end of the year?

A) $7,000.

B) $11,200.

C) $23,200.

D) $31,200.

Correct Answer:

Verified

Q41: Paris,a 60% partner in Omega Partnership,has a

Q42: Sabrina has a $12,000 basis in her

Q46: A partner had the following items reported

Q48: In 2014, Angel contributes land to a

Q49: Partner Spence had the following items reported

Q53: As a general rule,a distribution to a

Q55: Which of the following items decreases a

Q55: Rich is a partner in RKW partnership.

Q57: Sabrina has a $12,000 basis in her

Q59: Which of the following partnership items are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents