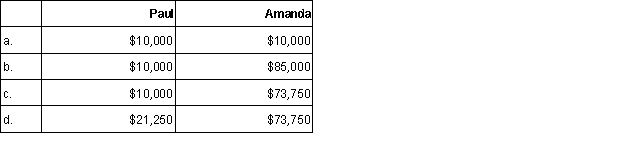

Paul invests $10,000 cash in an equipment leasing activity for a 15% ownership share in the business. The remaining 85% owner is Amanda. Amanda contributes $10,000 and personally borrows $75,000 that she also invests in the business. What are the at-risk amounts for Paul and Amanda?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q24: Rene owns four small businesses.Rene spends the

Q27: Which of the following is a passive

Q32: Itemized deductions are allowed in their entirety

Q34: Alice is an attorney and earned $175,000

Q37: The term "active participation" is used to

Q38: Baxter invested $50,000 in an activity in

Q38: Which of the following increases the taxpayer's

Q50: Denise's AGI is $145,000 before considering her

Q56: When determining whether a limited partnership loss

Q68: Identify factors that increase or decrease the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents