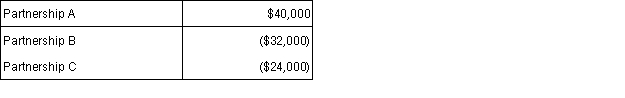

Alice is an attorney and earned $175,000 from her practice in the current year. Alice also owns three passive activities. The activities had the following income and losses:  What is Alice's adjusted gross income for the current year?

What is Alice's adjusted gross income for the current year?

A) $119,000.

B) $159,000.

C) $175,000.

D) $215,000.

Correct Answer:

Verified

Q23: Which of the following decreases a taxpayer's

Q24: Rene owns four small businesses.Rene spends the

Q27: Which of the following is a passive

Q32: Itemized deductions are allowed in their entirety

Q33: The standard deduction is added back as

Q35: Every taxpayer who calculates depreciation on his

Q37: The term "active participation" is used to

Q37: Paul invests $10,000 cash in an equipment

Q38: Baxter invested $50,000 in an activity in

Q38: Which of the following increases the taxpayer's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents