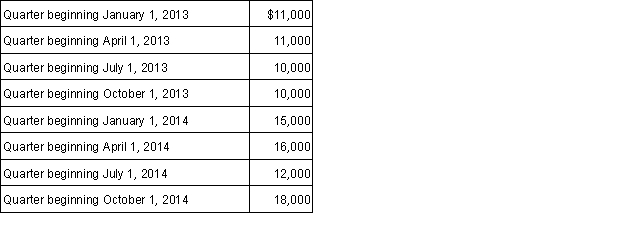

Griffith & Associates is trying to determine how often it needs to deposit payroll taxes for the calendar year 2015. The company made the following quarterly payroll tax deposits during the last two years:  a. What is the lookback period and amount?

a. What is the lookback period and amount?

b. In 2015, how often must Griffith & Associates make payroll deposits?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Sandy is a self-employed health information coder.

Q104: Claude works as a teacher during the

Q106: Maeda Company has the following employees on

Q107: Maeda Company has the following employees on

Q109: Carolyne earns $150,000 per year. She is

Q111: Jan hired Mike to dog sit for

Q112: Nikki's salary is $209,950 in 2015. How

Q113: Bonita is married and claims four exemptions

Q115: Hank received a bonus of $5,000 from

Q118: Failure to furnish a correct TIN to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents