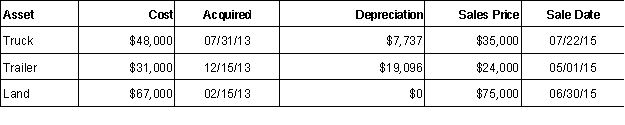

Jim, the owner of a sole proprietorship, sold the following assets in 2015:  Complete the following table: and the character of the realized and recognized gain or loss from the sale of each asset. Assume the land was held for investment and had a FMV of $73,000.

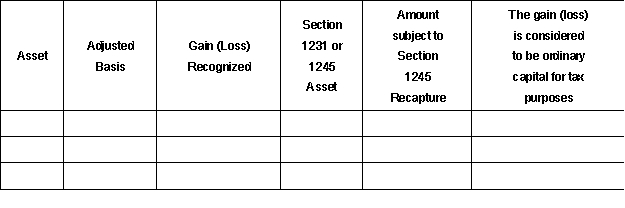

Complete the following table: and the character of the realized and recognized gain or loss from the sale of each asset. Assume the land was held for investment and had a FMV of $73,000.

Correct Answer:

Verified

Q102: Sara owns an automobile for personal use.The

Q110: Respond to the following independent situations:

a. Marie

Q113: Stephanie sold the following stock in 2015.

Q114: Norman received shares of stock as a

Q115: Otis, the taxpayer, has the following capital

Q116: Genevieve sold 300 shares of stock on

Q117: Dancing Feet Company, a sole proprietorship, acquired

Q118: Keeley purchased 1,000 shares in FAM Inc.,

Q119: Jess sold a piece of equipment she

Q120: Mikeala has taxable income of $73,240,without consideration

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents