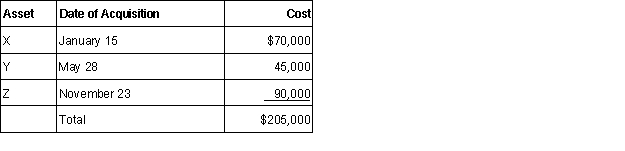

Tonia acquires the following 5-year class property in 2015:  Tonia does not elect §179 or bonus depreciation. Tonia has $300,000 of taxable income from her business. Determine her total cost recovery deduction for the year.

Tonia does not elect §179 or bonus depreciation. Tonia has $300,000 of taxable income from her business. Determine her total cost recovery deduction for the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: On April 23, 2015, Bailey purchased an

Q62: Terry, a CPA, flew from Dallas to

Q63: Nancy purchased a computer on July 15,

Q64: Sandy is the owner of ABC Loan

Q67: Lateefah purchased a new office building on

Q68: Beau earned $25,000 of net earnings from

Q69: Xavier bought furniture and fixtures (7-year property)

Q70: Alice is a high school teacher who

Q70: Bob took a business trip from Chicago

Q71: Alan owns a ranch in Kansas. During

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents