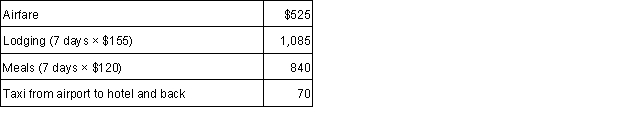

Terry, a CPA, flew from Dallas to New York to attend a conference. The conference lasted four days. Then she took three days of vacation to go sightseeing. Terry's expenses for the trip are as follows:  Calculate Terry's travel expense deduction.

Calculate Terry's travel expense deduction.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Which of the following individuals can deduct

Q58: Kiri acquires equipment (7-year property) on August

Q59: Marion drives 20 miles a day from

Q61: On April 23, 2015, Bailey purchased an

Q63: Nancy purchased a computer on July 15,

Q64: List and define the criteria for an

Q64: Sandy is the owner of ABC Loan

Q66: Tonia acquires the following 5-year class property

Q67: Lateefah purchased a new office building on

Q70: Alice is a high school teacher who

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents