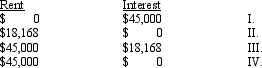

On January 1, 2014, Becky Company signed a lease agreement requiring six annual payments of $45,000, beginning December 31, 2014. The lease qualifies as an operating lease. Becky's incremental borrowing rate was 9% and the lessor's implicit rate, known by Becky, was 10%. The present value factors of an ordinary annuity of $1 for six periods for interest rates of 9% and 10% are 4.485919 and 4.355261, respectively. Rounded to the nearest dollar, interest and rent expenses for 2014 would be

A) I

B) II

C) III

D) IV

Correct Answer:

Verified

Q46: Exhibit 20-2 On January 1, 2014, Mary

Q47: On January 1, 2014, Watson Company signed

Q48: Exhibit 20-2 On January 1, 2014, Mary

Q49: Exhibit 20-2 On January 1, 2014, Mary

Q50: On January 1, 2014, Madison Company signed

Q52: On January 1, 2014, Mark Company leased

Q53: On January 1, 2014, Rhyme Co. leased

Q54: Exhibit 20-2 On January 1, 2014, Mary

Q55: On January 1, 2014, Kathy Corp. leased

Q56: On January 1, 2014, Renee Corp., a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents