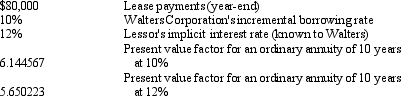

On January 3, 2014, the Walters Corporation signed a 10-year non-cancelable lease for manufacturing equipment. The fair value of the equipment at that time was $550,000. At the end of the lease period, the equipment, which has an estimated life of 15 years, will be returned to the lessor. Additional information is below:

Walters should

A) capitalize the equipment at $550,000

B) capitalize the equipment at $491,565

C) capitalize the equipment at $452,018

D) not capitalize the equipment

Correct Answer:

Verified

Q56: When is it appropriate for the lessee

Q61: A direct financing lease differs from a

Q61: Which of the following statements is true

Q64: On January 1, 2014, Stacie signed a

Q66: On January 1, 2014, Luke, Inc. leased

Q67: Which of the following facts would require

Q67: The Roger Company leased a machine at

Q71: A lease must be treated as a

Q72: On January 1, 2014, Stephen Corp., a

Q76: Depreciation expense will be recorded in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents