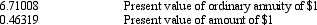

On January 1, 2014, Stephen Corp., a lessor, signed a direct financing lease. Stephen was to receive annual year-end payments of $10,000 for ten years, after which there was a guaranteed residual value of $8,000. The implicit interest rate was 8%. Actuarial information for 8%, ten periods follows: (round to the nearest whole dollar)

On January 1, 2014, Stephen should record a debit to Lease Receivable for

A) $67,100

B) $70,814

C) $100,000

D) $108,000

Correct Answer:

Verified

Q56: When is it appropriate for the lessee

Q61: A direct financing lease differs from a

Q61: Which of the following statements is true

Q67: Which of the following facts would require

Q67: The Roger Company leased a machine at

Q69: On January 3, 2014, the Walters Corporation

Q71: A lease must be treated as a

Q71: Which of the following is a required

Q76: On January 1, 2014, Stacie signed a

Q77: The lessee's disclosures should include the future

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents