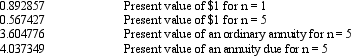

Exhibit 20-4 On January 1, 2014, Average Leasing Company entered into a direct financing lease with a lessee, Lenny Company. The lease agreement calls for five equal annual payments of $75,000 at the beginning of each year with the first payment due on January 1, 2014. The leased property has an estimated residual value of $10,000, which Lenny does not guarantee. The property remains the property of Average at the end of the lease term. Average desires a 12% rate of return. Present value factors for a 12% interest rate are as follows:

-Refer to Exhibit 20-4. What is the amount of interest revenue that Average should recognize on the lease for the year ended December 31, 2014? (Round the answer to the nearest dollar.)

A) $37,017

B) $28,017

C) $36,336

D) $27,336

Correct Answer:

Verified

Q65: Any initial direct costs incurred by the

Q66: One of the distinguishing characteristics of a

Q88: Exhibit 20-5 The Baltimore, Inc. entered into

Q89: Exhibit 20-4 On January 1, 2014, Average

Q91: Which of the following facts would preclude

Q92: Exhibit 20-5 The Baltimore, Inc. entered into

Q94: Exhibit 20-3 On January 1, 2014, Quinn

Q95: Exhibit 20-4 On January 1, 2014, Average

Q97: Exhibit 20-3 On January 1, 2014, Quinn

Q98: Which of the following items should be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents