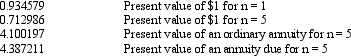

Exhibit 20-5 The Baltimore, Inc. entered into a five-year lease with the Waugh Chapel Company on January 1, 2014. Baltimore, the lessor, will require that five equal annual payments of $25,000 be made at the beginning of each year. The first payment will be made on January 1, 2014. The lease contains a bargain purchase option price of $12,000, which the lessee may exercise on December 31, 2018. The lessee pays all executory costs. The cost of the leased property and its normal selling price are $95,000 and $118,236, respectively. Collectibility of the future lease payments is reasonably assured, and the lessor does not expect to incur any future costs related to the lease. Present value factors for a 7% interest rate are as follows:

-Refer to Exhibit 20-5. If Baltimore requires a 7% annual return, what is the correct amount of interest revenue to be recognized by Baltimore for 2014? (Round the answer to the nearest dollar.)

A) $7,774

B) $7,175

C) $6,527

D) $5,928

Correct Answer:

Verified

Q65: Any initial direct costs incurred by the

Q73: In a sales-type lease

A) sales revenue ignores

Q75: A lessor enters into a sales-type lease.Which

Q83: Any initial direct costs incurred by the

Q83: Exhibit 20-5 The Baltimore, Inc. entered into

Q85: Depreciation expense will be recorded in the

Q89: Exhibit 20-4 On January 1, 2014, Average

Q91: Which of the following facts would preclude

Q92: Exhibit 20-5 The Baltimore, Inc. entered into

Q93: Exhibit 20-4 On January 1, 2014, Average

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents