On January 1, 2014, the Millwork Company signed a four-year non-cancelable lease of equipment from the Midford Company. The annual lease payments of $35,000 are to be paid on January 1 of each year. The first payment is due on January 1, 2014. The lease contains a bargain purchase option price of $15,000. The equipment's fair value is expected to be $30,000 on December 31, 2017. The estimated economic life of the equipment is six years, and the estimated residual value at the end of six years is $5,000. Millwork's incremental borrowing rate is 12%, and the implicit interest rate used in the lease agreement is 10%, which is known by Millwork.

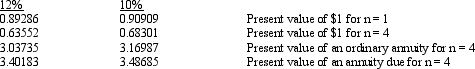

Present value factors for interest rates of 10% and 12% are as follows:

Millwork Company uses the straight-line method to depreciate its plant assets.

Required:

a.Compute the present value of the minimum lease payments. (Show all computations and round amounts to the nearest dollar.)

b.Classify the lease from the standpoint of the lessee, stating the reason for the classification.

c.Prepare a lease amortization schedule for the four-year term for Millwork Company. (Round amounts to the nearest dollar.)

d.What is the depreciation expense for 2014?

Correct Answer:

Verified

Q93: The lessor should report the Lease Receivable

Q94: Related to direct financing leases

A)the net investment

Q102: In a sales-leaseback transaction

A)the sale and leaseback

Q119: Lessee leased some land and buildings from

Q121: What is included in the calculation of

Q123: How is the present value of the

Q124: What are the four capitalization criteria in

Q125: The Boulder Company leased office equipment to

Q126: San Juan Corp. leased some equipment to

Q127: What four conditions can a lease be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents