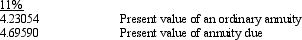

San Juan Corp. leased some equipment to Glendale, Inc. on January 1, 2014. The lease required six annual payments, with the first payment due on December 31, 2014. The cost, and also fair value, of the equipment was $140,000, and there was no estimated residual value at the end of the six-year period. The lease was a direct financing lease and does qualify as a capital lease for San Juan . San Juan 's desired rate of return is 11%. Use the following factors for 6 periods:  Required:

Required:

(For all answers, round to the nearest dollar.) (For all answers, round to the nearest dollar.)

a.Compute the amount of equal annual payments.

b.Prepare San Juan 's 1/1/2014 entry.

c.Prepare all December 31, 2014 entries on San Juan 's books.

d.Assume the same information, except that payments are due on January 1 of each year and the first payment was due on January 1, 2014. Determine the amount of the equal annual payments and determine the amount of interest revenue San Juan should recognize for the year 2014.

Correct Answer:

Verified

Q121: What is included in the calculation of

Q122: On January 1, 2014, the Millwork Company

Q123: How is the present value of the

Q124: What are the four capitalization criteria in

Q125: The Boulder Company leased office equipment to

Q127: What four conditions can a lease be

Q128: (This problem requires use of PV tables

Q129: One Republic Company leased equipment to Maps

Q130: Flagstaff, a lessor, entered into a sales-type

Q131: Beatrice, Inc. purchased equipment at a cost

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents