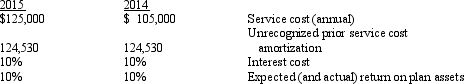

Exhibit 19-02 The Sophia Company adopted a defined benefit pension plan on January 1, 2014, and prior service credit was granted to employees. The present value of those benefits was calculated to be $1,245,300 at that date. The service cost is funded in full at the end of each year, plus an additional amount of $225,000 is funded each year-end. The unrecognized prior service cost is being amortized by the straight-line method over the remaining 10-year service life of the company's active employees. Additional information relating to the company's pension plan is presented below:

- Refer to Exhibit 19-02. What is the pension expense for 2014?

A) $105,000

B) $229,530

C) $315,000

D) $354,060

Correct Answer:

Verified

Q41: Vested benefits are

A)estimated benefits

B)not contingent on future

Q46: If a company uses the indirect method

Q52: Given the following information Q53: Exhibit 19-01 Marley Co. has an underfunded Q54: GAAP requires that a company record a Q55: ACE has a defined benefit pension plan. Q59: Which of the following statements regarding postretirement Q60: John Company adopted a defined benefit pension Q61: Attribution period starts on the Q62: The attribution period ends at![]()

A) hiring date

B)

A) the expected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents