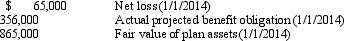

During 2013, the Electric Company experienced a difference between its expected and actual projected benefit obligation. At the beginning of 2014, Electric's actuary notified them of the following accumulated information related to their plan:  On December 31, 2014, Electric is in the process of calculating the net gain or loss to include in its pension expense for 2014. The average remaining service life of its employees is 10 years and there are no differences between the company's expected and annual rate of return on plan assets in 2014.

On December 31, 2014, Electric is in the process of calculating the net gain or loss to include in its pension expense for 2014. The average remaining service life of its employees is 10 years and there are no differences between the company's expected and annual rate of return on plan assets in 2014.

Required:

Compute the amount of the net gain or loss to include in the pension expense for 2014. Note whether it is an addition or subtraction to the pension expense.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Vested benefits are

A)estimated benefits

B)not contingent on future

Q59: Which of the following statements regarding postretirement

Q60: John Company adopted a defined benefit pension

Q61: Attribution period starts on the

A) hiring date

B)

Q62: The attribution period ends at

A) the expected

Q64: In 2014, the Electrician Company decided to

Q65: The following information is related to a

Q66: In 2014, the Ballaster Company decided to

Q67: Jennifer Corp's defined benefit pension plan had

Q68: Which of the following disclosures are required

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents