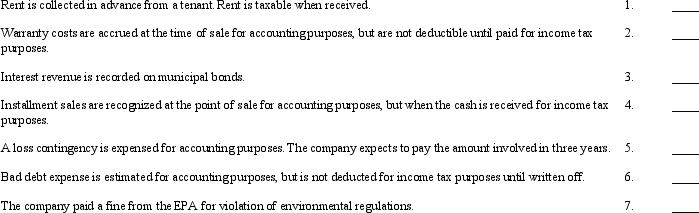

For each item listed below, indicate whether it involves a:

a.permanent difference.

b.temporary difference that will result in future deductible amounts (giving rise to deferred tax assets).

c.temporary difference that will result in future taxable amounts (giving rise to deferred tax liabilities).

Required:

Match each item to its descriptive phrase by placing the appropriate letter in the space provided.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Which of the following are required disclosures

Q63: At December 31, 2014, the Blue Agave

Q64: The acceptable balance sheet classifications for deferred

Q65: Assuming there are no prior period adjustments

Q67: The Chance Company began operations in 2014

Q68: The Wyatt Company reports the following for

Q69: Intraperiod tax allocation would be appropriate for

A)

Q70: Which one of the following transactions would

Q70: Smyrna Company had financial and taxable incomes

Q71: The presentation of the combination or "offsetting"

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents