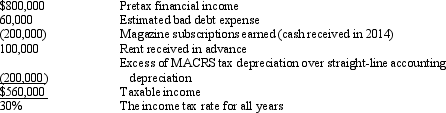

At December 31, 2014, the Blue Agave Company had a current deferred tax asset of $60,000, arising from cash for magazine subscriptions received and taxed in 2014 but that will be recognized as income for accounting purposes in 2015; a noncurrent deferred tax liability of $160,000 arising from an excess of MACRS tax depreciation over straight-line accounting depreciation of plant assets; and a long-term deferred tax asset of $80,000, arising from contingency expenses for accounting purposes that will be tax deductible when paid (estimated to be in 2016). The 2015 pretax financial income and taxable income for Blue Agave are as follows:

Required:

Prepare the income tax journal entry for the Blue Agave Company at the end of 2015.

Correct Answer:

Verified

Q4: Interperiod income tax allocation is based on

Q19: In accounting for income taxes, percentage depletion

Q60: In 2014, the Puerto Rios Company received

Q61: Which of the following are required disclosures

Q64: The acceptable balance sheet classifications for deferred

Q65: Assuming there are no prior period adjustments

Q66: For each item listed below, indicate whether

Q67: The Chance Company began operations in 2014

Q68: The Wyatt Company reports the following for

Q70: Which one of the following transactions would

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents