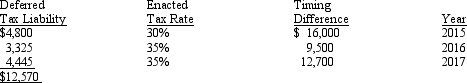

On December 31, 2014, the Town Hall Company had a deferred tax liability balance of $12,570, arising from an excess of MACRS depreciation for tax purposes over straight-line depreciation for accounting purposes. The tax effects of that timing difference are expected to reverse in the following years:

On January 27, 2015, Congress raised the effective income tax rate to 38% for all future years, including the current year, 2015.

Required:

Prepare the entry to record any adjustments necessary due to the income tax rate increase on January 27, 2015.

Correct Answer:

Verified

Q63: The recognition of gross profit on installment

Q65: Which one of the following requires intraperiod

Q70: Smyrna Company had financial and taxable incomes

Q71: The presentation of the combination or "offsetting"

Q71: Income taxes for financial accounting purposes are

Q76: In applying intraperiod income tax allocation to

Q77: Which one of the following would require

Q78: On December 31, 2013, Jefferson Lake, Inc.

Q79: Moore Company reported the following operating results

Q80: Which of the following is false concerning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents