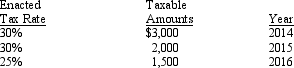

On December 31, 2013, Jefferson Lake, Inc. reported a deferred tax liability of $1,875, based on the following schedule of future taxable amounts and enacted tax rates:

On February 7, 2014, Congress amended a previously passed tax law. The amendment changed the tax rate to 35% for 2014 and all future years.

Required:

Prepare the income tax journal entry for Jefferson Lake, Inc. necessary on February 7, 2014.

Correct Answer:

Verified

Q63: The recognition of gross profit on installment

Q65: Which one of the following requires intraperiod

Q71: Income taxes for financial accounting purposes are

Q75: On December 31, 2014, the Town Hall

Q76: In applying intraperiod income tax allocation to

Q79: Moore Company reported the following operating results

Q80: Which of the following is false concerning

Q81: Delmarva Company, during its first year of

Q82: James Company reports the following information related

Q83: Jefferson Corporation reported the following pretax and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents