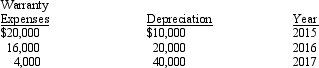

Delmarva Company, during its first year of operations in 2014, reported taxable income of $170,000 and pretax financial income of $100,000. The difference between taxable income and pretax financial income was caused by two timing differences: excess depreciation on tax return, $70,000; and warranty expenses in excess of warranty payments, $40,000. These two timing differences will reverse in the next three years as follows:

Enacted tax rates are 30% for 2014, 35% for 2015 and 2016, and 40% for 2017.

Required:

Prepare the income tax journal entry for Delmarva Company for December 31, 2014.

Correct Answer:

Verified

Q71: Income taxes for financial accounting purposes are

Q76: In applying intraperiod income tax allocation to

Q78: On December 31, 2013, Jefferson Lake, Inc.

Q79: Moore Company reported the following operating results

Q80: Which of the following is false concerning

Q82: James Company reports the following information related

Q83: Jefferson Corporation reported the following pretax and

Q84: At the end of its first year

Q85: Fairfax Company had a balance in Deferred

Q108: What are the three types of permanent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents