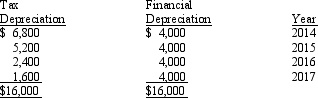

Fairfax Company had a balance in Deferred Tax Liability of $840 on December 31, 2014, resulting from depreciation timing differences. Differences in tax and accounting depreciation for assets purchased on January 1, 2014, are as follows:

In addition to the 2014 depreciation timing difference, Fairfax Company expensed $2,000 of warranty costs that will be deducted for tax purposes when paid in future years. Fairfax's taxable income in 2014 was $35,000. The 2014 income tax rate was 35%, and no changes in the tax rate for future years have been enacted.

Required:

Prepare the income tax journal entry for the Fairfax Company for December 31, 2014.

Correct Answer:

Verified

Q80: Which of the following is false concerning

Q81: Delmarva Company, during its first year of

Q82: James Company reports the following information related

Q83: Jefferson Corporation reported the following pretax and

Q84: At the end of its first year

Q86: Differences arising between financial accounting and tax

Q87: Thorn Corporation has deductible and taxable temporary

Q88: The following information relates to the Kill

Q89: What conclusion did FASB come to in

Q108: What are the three types of permanent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents