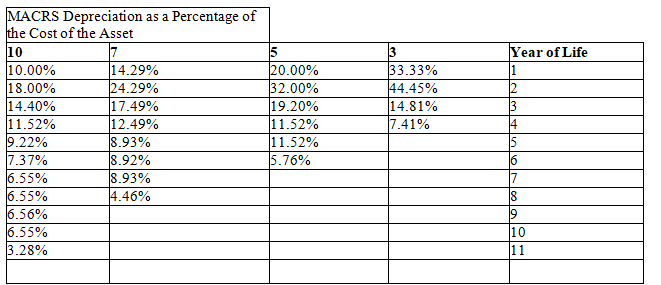

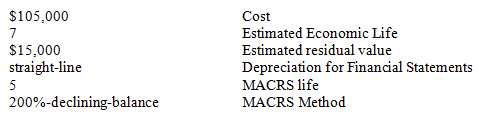

Exhibit 11-05 Wilson is preparing his tax returns using the MACRS convention. The following information relates to the purchase of an asset on January 1, 2013.

-Refer to Exhibit 11-05, what amount of depreciation would be recorded on the income tax returns for year 5?

A) $6,048

B) $15,000

C) $12,096

D) $0

Correct Answer:

Verified

Q111: Javlin Farms purchased three new tractors for

Q112: The Roberto Company purchased a limo for

Q113: Green Vegetable Mfg. Co. purchased equipment on

Q114: The following are a list of terms:

Q115: On January 2, 2014, China Co. bought

Q117: On January 1, 2014, Check Co. bought

Q118: Consider the following:

a.Peters Co. bought a

Q119: On January 1, 2014, World Inc. purchased

Q120: On April 20, 2014, Maskell Co. purchased

Q128: What costs can be capitalized as part

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents