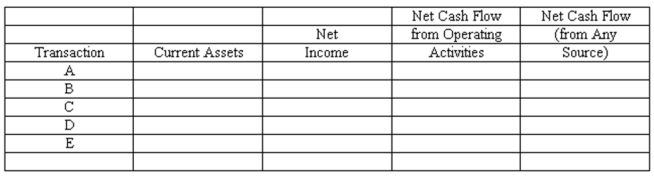

Financial assets-effects of transactions

Five events involving financial assets are described below:

(a.) Sold merchandise on account.

(b.) Sold available-for-sale marketable securities at a gain. Cash proceeds from the sale were equal to the current market value of the securities reflected in the last balance sheet.

(c.) Collected an account receivable.

(d.) Adjusted the allowance for doubtful accounts to reflect the portion of accounts receivable estimated to be uncollectible at year-end.

(e.) Made mark-to-market adjustment reducing the balance in the available-for-sale marketable securities account to reflect a decrease in the market value of securities owned.

Indicate the effects of each independent transaction or adjusting entry upon the financial measurements shown in the four column headings below. Use the code letters, I for increase, D for decrease, and NE for no effect.

Correct Answer:

Verified

*Note to Instructor: Exchanging marketa...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q181: Balance sheet method-computations

Rainbow Company uses the balance

Q186: Accounts receivable turnover rate

During 2010, Larsen Company's

Q187: Bank reconciliation--computation and journal entry

The Cash account

Q188: At December 31, 2009, Laconia Industries' portfolio

Q189: Note receivable--journal entries

On September 1, 2010, Dental

Q190: Notes receivable-computations

Complete the following statements about promissory

Q193: Bank reconciliation--computations and journal entry

The Cash account

Q195: Internal control over cash transactions

(a.) Describe three

Q196: Bank reconciliation

(A.) You are to complete the

Q197: Balance sheet method-journal entries

The general ledger controlling

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents