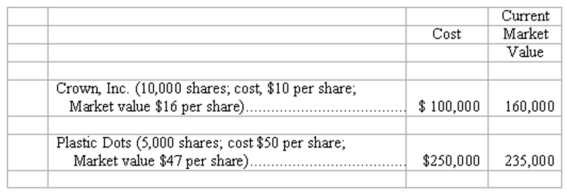

At December 31, 2009, Laconia Industries' portfolio of investments in available-for-sale marketable securities consisted of the following:

(a.) Illustrate the presentation of marketable securities and unrealized holding gain (or loss) in Laconia's financial statements at December 31, 2009. Indicate the financial statement and section in which each item appears.

(b.) Assume that on March 15, 2010, Laconia made the following sales of securities:

(1) Sold 5,000 shares of its investment in Crown, Inc., at a price of $20 per share.

(2) Sold 1,000 shares of its investment in Plastic Dots at a price of $45 per share.

Compute the gain or loss recognized in Laconia's 2010 income statement for each sale:

(1). Sale of 5,000 shares of Crown: $____________ Gain/Loss

(2). Sale of 1,000 shares of Plastic Dots: $____________ Gain/Loss

(c.) At December 31, 2010, the market values of these stocks are: Crown, $21 per share; Plastic Dots, $42 per share. Complete the following schedule showing cost and current market value of securities owned by Laconia at the end of 2010.

(d.) Illustrate the presentation of marketable securities and unrealized holding gain (or loss) in Laconia's financial statements at December 31, 2010. (Follow same format as in part

Correct Answer:

Verified

Q181: Balance sheet method-computations

Rainbow Company uses the balance

Q184: Financial assets--effects of transactions

Five events involving financial

Q185: Uncollectible accounts--two methods

At the end of the

Q186: Accounts receivable turnover rate

During 2010, Larsen Company's

Q187: Bank reconciliation--computation and journal entry

The Cash account

Q189: Note receivable--journal entries

On September 1, 2010, Dental

Q190: Cash management

(a. )What is meant by the

Q190: Notes receivable-computations

Complete the following statements about promissory

Q191: Financial assets-effects of transactions

Five events involving financial

Q193: Bank reconciliation--computations and journal entry

The Cash account

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents