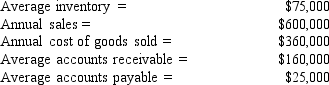

Marshall Inc.recently hired your consulting firm to improve the company's performance.It has been highly profitable but has been experiencing cash shortages due to its high growth rate.As one part of your analysis, you want to determine the firm's cash conversion cycle.Using the following information and a 365-day year, what is the firm's present cash conversion cycle?

A) 120.6 days

B) 126.9 days

C) 133.6 days

D) 140.6 days

E) 148.0 days

Correct Answer:

Verified

Q103: Data on Liu Inc.for the most recent

Q104: Carter & Carter is considering setting up

Q105: The company you just started has been

Q106: Data on Nathan Enterprises for the most

Q107: Data on Mertz Co.for the most recent

Q109: Newsome Inc.buys on terms of 3/15, net

Q110: Krackle Korn Inc.had credit sales of $3,

Q111: Mark's Manufacturing's average age of accounts receivable

Q112: Baltimore Baking is preparing its cash budget

Q113: Tierney Enterprises is constructing its cash budget.Its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents