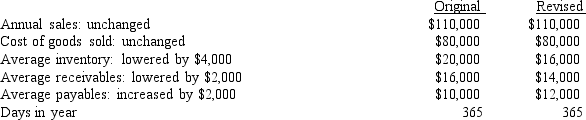

Kiley Corporation had the following data for the most recent year (in millions) .The new CFO believes (1) that an improved inventory management system could lower the average inventory by $4, 000, (2) that improvements in the credit department could reduce receivables by $2, 000, and (3) that the purchasing department could negotiate better credit terms and thereby increase accounts payable by $2, 000.Furthermore, she thinks that these changes would not affect either sales or the costs of goods sold.If these changes were made, by how many days would the cash conversion cycle be lowered?

A) 34.0

B) 37.4

C) 41.2

D) 45.3

E) 49.8

Correct Answer:

Verified

Q110: Krackle Korn Inc.had credit sales of $3,

Q111: Mark's Manufacturing's average age of accounts receivable

Q112: Baltimore Baking is preparing its cash budget

Q113: Tierney Enterprises is constructing its cash budget.Its

Q114: Thornton Universal Sales' cost of goods sold

Q116: Buchholz Corporation follows a moderate current asset

Q117: Whitson Co.is looking for ways to shorten

Q118: Freeman Builders, Inc.buys on terms of 2/15,

Q119: Shulman Inc.has the following data, in thousands.Assuming

Q120: Pascarella Inc.is revising its payables policy.It has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents