Typical Corp. reported a deferred tax liability of $6,000,000 for the year ended December 31, 2008, when the tax rate was 40%. The deferred tax liability was related to a temporary difference of $15,000,000 caused by an installment sale in 2008. The temporary difference is expected to reverse in 2010 when the income deferred from taxation will become taxable. There are no other temporary differences. Assume a new tax law passed in 2009 and the tax rate, which will remain at 40% for through December 31, 2009, will become 48% for tax years beginning after December 31, 2009. Taxable income for the year 2009 is $30,000,000.

Required:

Prepare two footnotes for Typical's year 2009 financial statements to:

(a.) Show the composition of Typical's income tax expense for the year.

(b.) Explain the classification and description of the deferred tax liability.

Give supporting computations to show how you arrived at the dollar amounts disclosed in your footnotes.

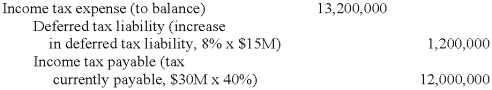

Students may show the journal entry for the year 2009 tax provision as supporting detail:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: North Dakota Corporation began operations in January

Q107: The following information is for Hulk Gyms'

Q110: Gore Company, organized on January 2,

Q111: Will LMC report $819.9 million as a

Q113: Indicate why LMC lists Net operating loss

Q141: In the current year, Bruno Corporation collected

Q142: In LMC's 2018 annual report to shareholders,

Q153: At the end of the prior year,

Q158: At the end of its first year

Q159: At the end of the preceding year,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents