Problem Four: Dell Financial Risk

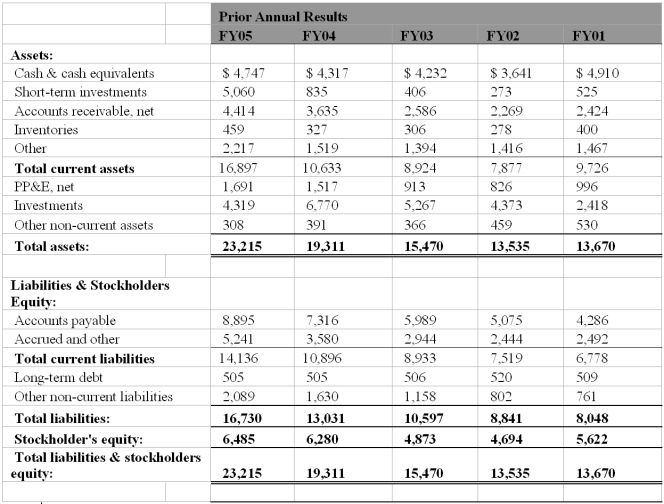

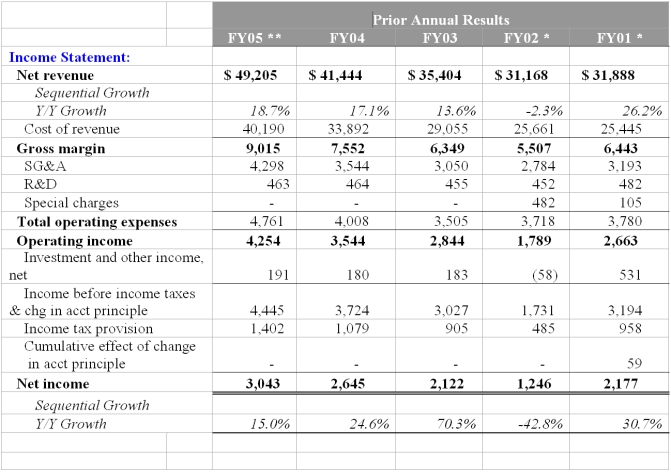

Following are Dell's condensed consolidated statement of financial position and condensed consolidated statement of operations, in millions (unaudited).

Statement of Financial Position

Statement of Operations

a. Using the above information, calculate the following ratios for FY05 to FY02:

1. Current ratio

2. Quick ratio

3. Working capital

4. Days in accounts receivable

5. Days supply in inventory

6. Days in accounts payable

7. Net days working capital

8. Long-term debt to assets ratio

9. Debt to equity ratio

10. liabilities to total assets

b. Comment on the changes to Dell's liquidity risk

c. Comment on the changes to Dell's solvency risk

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Consider each of the following situations independently

Q81: The total debt to total capital ratio

Q85: Capitalization of interest results in an understatement

Q89: "Trading on the equity" means that a

Q91: Debt may contain sinking fund provisions. This

Q94: Debt is better than equity because the

Q99: Minority shareholders' interest on the balance sheet

Q102: Problem Six: Wal*Mart

Refer to Wal*Mart's financial

Q103: Problem Eight: Effect of Interest Rate Changes

Q104: Problem Seven: Consolidation vs. Equity

Company ABC has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents