Problem Six: Wal*Mart

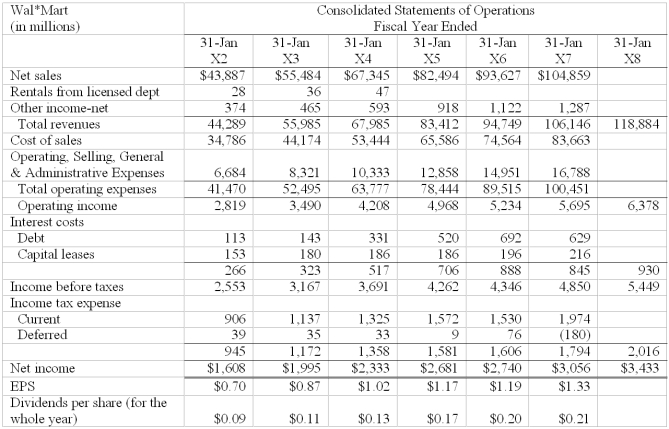

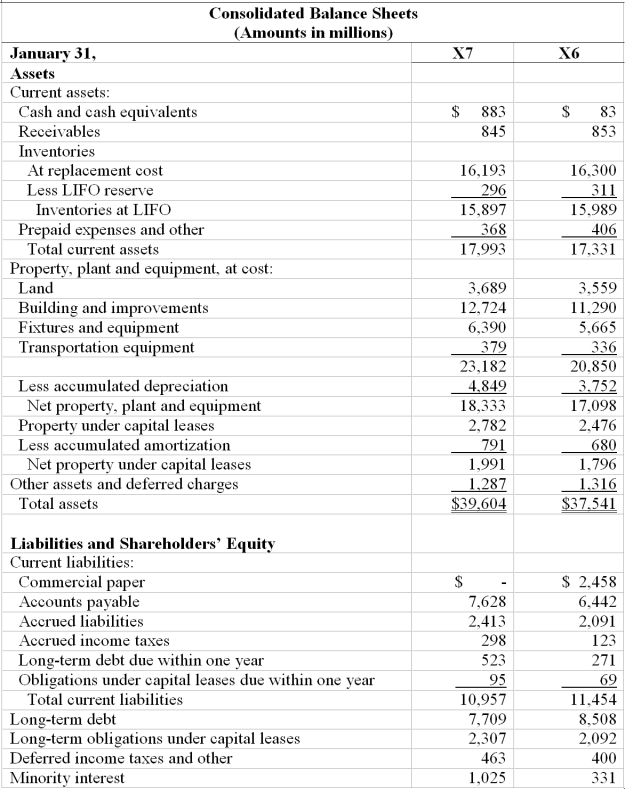

Refer to Wal*Mart's Financial Statements, Below A Calculate: Total Debt/equity Ratio and Times Interest Earned Ratio

Problem Six: Wal*Mart

Refer to Wal*Mart's financial statements, below.

a. Calculate: total debt/equity ratio and times interest earned ratio for fiscal X6 and X7. Comment on your results.

b. Analysis of Wal*Mart's footnotes reveals the existence of significant operating leases. Explain whether this would change your answer in part a) and how you would make the changes.

Correct Answer:

Verified

Total debt to equity = 0.91

Times...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Consider each of the following situations independently

Q81: The total debt to total capital ratio

Q85: Capitalization of interest results in an understatement

Q89: "Trading on the equity" means that a

Q91: Debt may contain sinking fund provisions. This

Q94: Debt is better than equity because the

Q99: Minority shareholders' interest on the balance sheet

Q101: Problem Four: Dell Financial Risk

Following are Dell's

Q103: Problem Eight: Effect of Interest Rate Changes

Q104: Problem Seven: Consolidation vs. Equity

Company ABC has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents