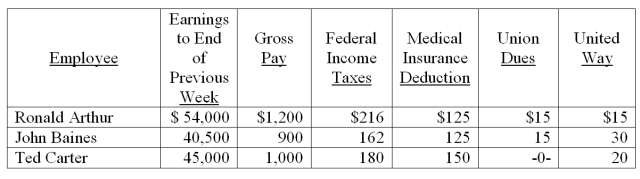

The payroll records of a company provided the following data for the weekly pay period ended December 7:

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

Salaries and Wages Expense = ($1,200 + $900 + $1,000) = $3,100

Federal Income Taxes Payable = ($216 + $162 + $180) = $558

Medical Insurance Payable = (125 + 125 + 150) = 400

Union Dues Payable = ($15 + $15) = $30

United Way Payable = ($15 + $30 + $20) = $65

FICA-Social Security Taxes Payable = ($3,100 x .062) = $192.20

FICA-Medicare Taxes Payable = ($3,100 x .0145) = $44.95

Correct Answer:

Verified

Q133: Metro Express has 5 sales employees, each

Q139: An employee earned $3,450 for the current

Q145: A company borrowed $60,000 on a 60-day,10%

Q150: The rate for FICA-social security is 6.2%

Q153: On November 1,2009,Bob's Skateboards Store signed a

Q156: A company's payroll information for the

Q160: The payroll records of a company provided

Q160: _ are obligations due within one year

Q168: A company sells personal computers,with an included

Q172: A _ is a potential obligation arising

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents