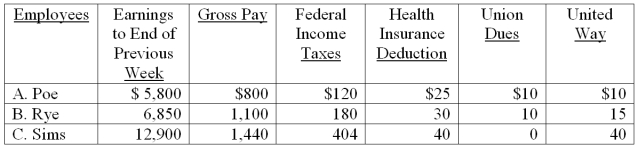

The payroll records of a company provided the following data for the currently weekly pay period ended March 7.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Correct Answer:

Verified

Q145: A company borrowed $60,000 on a 60-day,10%

Q150: The rate for FICA-social security is 6.2%

Q153: On November 1,2009,Bob's Skateboards Store signed a

Q156: A company's payroll information for the

Q157: The payroll records of a company provided

Q160: _ are obligations due within one year

Q170: _ allowances are items that reduce the

Q172: A _ is a potential obligation arising

Q176: If Jefferson Company paid a bonus equal

Q195: Contingent liabilities are recorded in the accounts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents