MAX Inc. purchased 80% of the voting shares of MIN Inc for $750,000 on January 1, 2015. On that date, MAX's common shares and retained earnings were valued at $300,000 and $150,000 respectively. Unless otherwise stated, assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

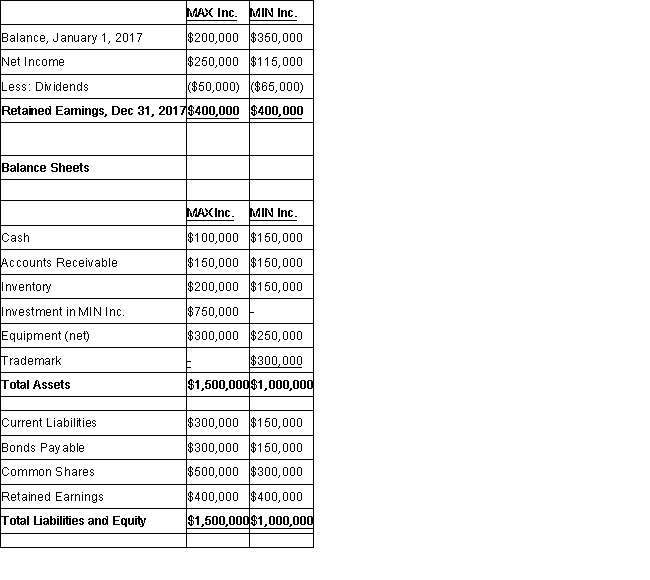

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Calculate Consolidated Retained Earnings as at December 31, 2017.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: What amount will appear on the "Gain

Q50: YIN Inc. purchased 75% of the

Q51: MAX Inc. purchased 80% of the

Q52: The amount of goodwill arising from this

Q53: In your own words, explain what effect

Q55: YIN Inc. purchased 75% of the

Q56: On December 31, 2015, the land account

Q57: MAX Inc. purchased 80% of the

Q58: On December 31, 2016, the land account

Q59: What effect will the elimination of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents