YIN Inc. purchased 75% of the voting shares of YANG Inc for $500,000 on July 1, 2015. On that date, YANG Inc.'s Common Shares and Retained Earnings were valued at $200,000 and $100,000 respectively. Unless otherwise stated, assume that YIN uses the cost method to account for its investment in YANG Inc.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

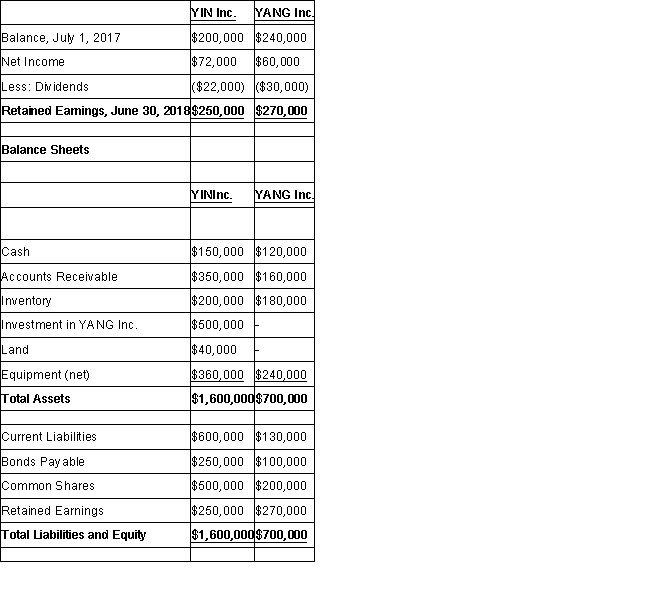

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

-Compute YIN's Goodwill at the date of acquisition.

Correct Answer:

Verified

Q45: What amount will appear on the "Gain

Q46: Prepare a schedule showing the realized and

Q47: What would be the balance in the

Q48: MAX Inc. purchased 80% of the

Q49: What amount will appear on the "Gain

Q51: MAX Inc. purchased 80% of the

Q52: The amount of goodwill arising from this

Q53: In your own words, explain what effect

Q54: MAX Inc. purchased 80% of the

Q55: YIN Inc. purchased 75% of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents