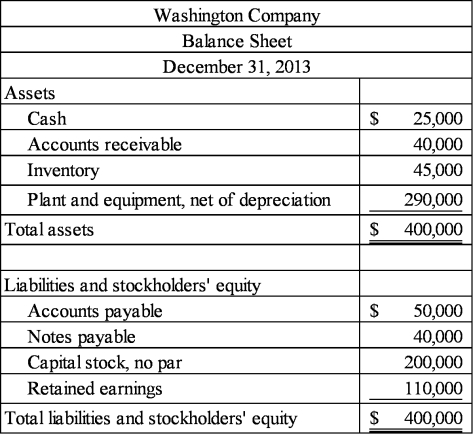

Washington Company's balance sheet as of December 31, 2013 is provided below:

In anticipation of preparing the operating budget for the upcoming period, the firm's accountant has gathered the following information:

(a) Sales are budgeted at $320,000 for January 2014. Of these sales, half will be cash sales and half will be credit sales. Eighty percent of the credit sales are collected in the month of sale and the remainder is collected in the next month. Therefore, all of the December 31 receivables will be collected in January.

(b) Inventory purchases are expected to total $200,000 during January, all on account. Sixty percent of all purchases are paid for in the month of purchase and the remainder is paid in the following month. Therefore, all of the December 31 accounts payable will be paid during January. The inventory account is expected to have a $40,000 balance at January 31, 2014.

(c) Selling and administrative expenses for January are budgeted at $100,000 (exclusive of depreciation). S&A expenses are paid in cash. Depreciation is budgeted at $3,000 for the month.

(d) The notes payable will be paid in April. There is no cash outflow related to the note in January.

The sales manager wishes to purchase a new display case for the showroom during January if sufficient funds are available. The equipment has a cost of $9,000.

Required:

Can the company afford to purchase the display equipment without additional borrowing? Prepare a cash budget for January 2014 to support your answer. Be sure to show your computations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q122: Rachel Robinson owns a small retail store

Q139: Indicate whether each of the following statements

Q140: The Game Zone sells computer and

Q141: Najimi Enterprises recently began selling on internet.

Q142: A management accountant was working on

Q144: Greenhill Company's balance sheet as of December

Q145: Tableware Unlimited Company plans to sell china

Q146: Sound Effects Audio Systems sells and

Q147: The accountant for Haven Industries could not

Q148: Virginia Jackson is opening Jackson Realty

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents