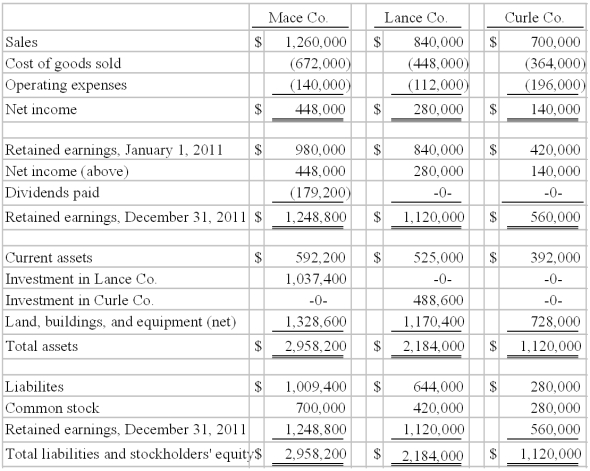

On January 1, 2010, Mace Co. acquired 75% of Lance Co.'s outstanding common stock. On the same date, Lance acquired an 80% interest in Curle Co. Both of these investments were acquired when book value was equal to fair value of identifiable net assets acquired. Both of these investments were accounted using the initial value method. No dividends were distributed by either Lance or Curle during 2010 or 2011. Mace paid cash dividends each year equal to 40% of operating income. Reported operating income totals for 2010 were as follows:  Following are the 2011 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2010) and $140,000 (2011). These transactions included the same markup applicable to Curle's outside sales. In each of these years, Lance carried 20% of this inventory into the succeeding year before disposing of it.

Following are the 2011 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2010) and $140,000 (2011). These transactions included the same markup applicable to Curle's outside sales. In each of these years, Lance carried 20% of this inventory into the succeeding year before disposing of it.

An effective income tax rate of 45% was applicable to all companies.

-Required:

Determine the noncontrolling interest in Lace Co.'s net income for the year 2011.

Correct Answer:

Verified

Q86: B Co. owned 70% of the voting

Q104: Required:

Prepare a schedule to show consolidated net

Q108: Jull Corp. owned 80% of Solaver Co.

Q109: Kurton Inc. owned 90% of Luvyn Corp.'s

Q110: On January 1, 2010, Mace Co. acquired

Q111: Jull Corp. owned 80% of Solaver Co.

Q112: Patton's operating income excludes income from

Q113: Dotes, Inc. owns 40% of Abner Co.

Q116: Kurton Inc. owned 90% of Luvyn Corp.'s

Q117: On January 1, 2010, Mace Co. acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents