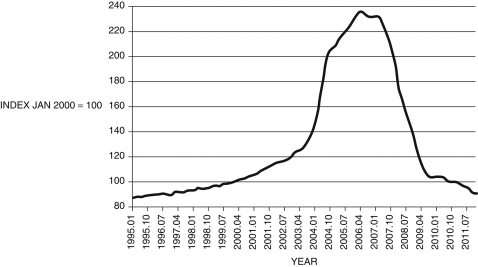

Consider Figure 17.9 below. As can be seen, real estate prices began to bubble in about 2005. Use the house price arbitrage equation to explain how each of the following may have contributed to this bubble:

a. Interest rates, in particular mortgage rates, which fell between 2000 and 2005;

b. Increasingly lax lending practices, with lower down payments, for home mortgages; and

c. The incentive to invest in residential real estate as home prices in Las Vegas increased.

Figure 17.9: Las Vegas Housing Price Index: 1995-2012

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: According to the financial asset arbitrage equation,

Q97: The financial asset arbitrage equation is

Q100: The arbitrage condition for capital shows that

Q104: See Figure 17.6 below.

Also, as

Q106: Figure 17.5: Investment-Output Ratio 2005-2012

Q108: From the residential arbitrage equation, a rise

Q112: Nonresidential fixed investment, residential fixed investment, and

Q113: Over the long run, the average P/E

Q115: Figure 17.7: Price-Earnings Ratio: 1985-2012

Q116: Figure 17.8: Weekly Percent Change in Apple

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents