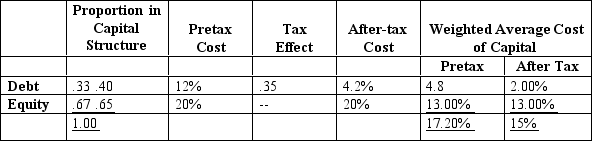

Suppose a firm faces the following costs of capital:

Assume that this firm expects to generate $95 million of pretax-free cash flows.

Assume that this firm expects to generate $95 million of pretax-free cash flows.

Required:

(1)What would be the after-tax free cash flows one year from today?

(2)Assuming a one-year horizon,what is the appropriate valuation to be used by the analyst?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: When should an analyst use nominal cash

Q48: What three elements are needed to value

Q50: Explain "free" cash flows.Describe which types of

Q53: Clarmont Corporation engaged in the following cash

Q54: Net income for the year for Tanglewood

Q55: Morgan Company reported the following items in

Q58: Shady Sunglasses operates retail sunglass kiosks in

Q59: Below is a condensed version of the

Q61: Financial statements for Hawk Company are presented

Q62: At December 31,2013,Cash was $70,200,Accounts Receivable was

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents