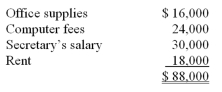

Terri Martin,CPA provides bookkeeping and tax services to her clients.She charges a fee of $60 per hour for bookkeeping and $90 per hour for tax services.Martin estimates the following costs for the upcoming year:  Operating profits declined last year and Ms.Martin has decided to use activity-based costing (ABC) procedures to evaluate her hourly fees.She gathered the following information from last year's records:

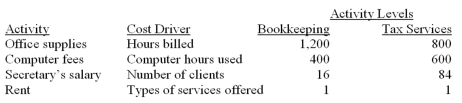

Operating profits declined last year and Ms.Martin has decided to use activity-based costing (ABC) procedures to evaluate her hourly fees.She gathered the following information from last year's records:  Martin wants her hourly fees for the tax services to be 160% of their activity-based costs.What is the fee per hour for tax services in the upcoming year?

Martin wants her hourly fees for the tax services to be 160% of their activity-based costs.What is the fee per hour for tax services in the upcoming year?

A) $70.40.

B) $88.00.

C) $110.00.

D) $118.40.

Correct Answer:

Verified

Q50: Terri Martin,CPA provides bookkeeping and tax services

Q51: RS Company manufactures and distributes two products,R

Q52: Terri Martin,CPA provides bookkeeping and tax services

Q53: RS Company manufactures and distributes two products,R

Q54: Smelly Perfume Company manufactures and distributes several

Q56: Smelly Perfume Company manufactures and distributes several

Q57: The LMN Company recently switched to activity-based

Q58: Smelly Perfume Company manufactures and distributes several

Q59: Zela Company is preparing its annual profit

Q60: RS Company manufactures and distributes two products,R

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents