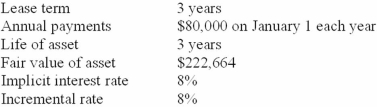

Python Company leased equipment from Hope Leasing on January 1, 2013. Hope purchased the equipment at a cost of $222,664.

Other information:  There is no expected residual value.

There is no expected residual value.

Required:

Prepare appropriate journal entries for Python for 2013. Assume straight-line depreciation and a December 31 year-end.

Correct Answer:

Verified

Q106: Warren Co. recorded a right-of-use asset of

Q107: Carla Salons leased equipment from SmithCo on

Q108: Elf Leasing purchased a machine for $500,000

Q109: Carla Salons leased equipment from SmithCo on

Q110: Red Co. recorded a residual asset of

Q112: Carla Salons leased equipment from SmithCo on

Q113: On January 1, 2013, Salvatore Company leased

Q114: Southern Edison Company leased equipment from Hi-Tech

Q115: Each of the four independent situations below

Q116: Each of the independent situations below describes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents