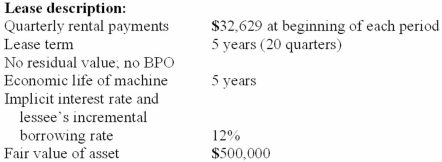

Elf Leasing purchased a machine for $500,000 and leased it to IGA, Inc., on January 1, 2013.  Collectibility of the rental payments is reasonably assured, and there are no lessor costs yet to be incurred.

Collectibility of the rental payments is reasonably assured, and there are no lessor costs yet to be incurred.

Required:

Prepare appropriate entries for both IGA and Elf Leasing from the inception of the lease through the second rental payment on April 1, 2013. Depreciation is recorded at the end of each fiscal year (December 31).

Correct Answer:

Verified

Q103: On January 1, 2013, Salvatore Company leased

Q104: On January 1, 2013, Holbrook Company leased

Q105: Eastern Edison Company leased equipment from Hi-Tech

Q106: Warren Co. recorded a right-of-use asset of

Q107: Carla Salons leased equipment from SmithCo on

Q109: Carla Salons leased equipment from SmithCo on

Q110: Red Co. recorded a residual asset of

Q111: Python Company leased equipment from Hope Leasing

Q112: Carla Salons leased equipment from SmithCo on

Q113: On January 1, 2013, Salvatore Company leased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents