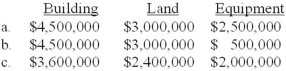

Cantor Corporation acquired a manufacturing facility on four acres of land for a lump-sum price of $8,000,000. The building included used but functional equipment. According to independent appraisals, the fair values were $4,500,000, $3,000,000, and $2,500,000 for the building, land, and equipment, respectively. The initial values of the building, land, and equipment would be:

A) Option a

B) Option b

C) Option c

D) None of the above.

Correct Answer:

Verified

Q25: The capitalized cost of equipment excludes:

A) Maintenance.

B)

Q27: Holiday Laboratories purchased a high-speed industrial centrifuge

Q31: Use the following to answer questions

Montana Mining

Q32: Use the following to answer questions

Montana Mining

Q35: Which of the following does not pertain

Q39: When selling property, plant, and equipment for

Q40: Simpson and Homer Corporation acquired an office

Q41: Interest is eligible to be capitalized as

Q41: In Case B,Grand Forks would record a

Q42: In Case B, Pensacola would record a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents