Use the fact that the pseudo-probability of default at time zero is (1/ 2) to answer the questions that follow.

Use the fact that the pseudo-probability of default at time zero is (1/ 2) to answer the questions that follow.

-Consider a floorlet with maturity time 1 and strike price 0.035.What are the payoffs to the option at time 1 in the up and down nodes?

A) 0.0307,0.0402

B) 0.0042,0.0000

C) 0.0354,0.0056

D) 0.0050,0.0050

E) 0.0000,0.0050

Correct Answer:

Verified

Q13: A necessary and sufficient condition to

Q14: An interest rate floor is:

A) a European

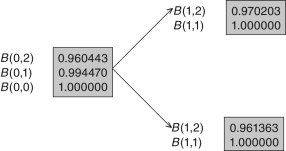

Q15: Use the following tree to answer the

Q16: Q17: Assume zero-coupon bond prices are B(0,0)= $1,B(0,1)= Q18: Use the following tree to answer the Q19: Suppose that a portfolio manager has purchased Q20: Which of the following statements is INCORRECT? Q21: Q22: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

A)![]()

![]()