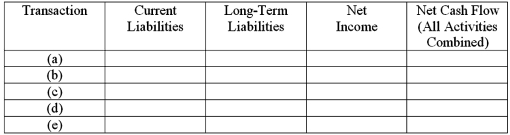

Effects of transactions upon financial measurements

Five events relating to liabilities are described below:

(a)Recorded a bi-weekly payroll,including the issuance of paychecks to employees.Amounts withheld from employees' pay and payroll taxes will be forwarded to appropriate agencies in the near future.(Ignore post-retirement costs.)

(b)Made a monthly payment on a 12-month installment note payable,including interest and a partial repayment of the principal amount.

(c)Shortly before the maturity date of a six-month bank loan,made arrangements with the bank to refinance the loan on a long-term basis.

(d)Made an adjusting entry to record accrued interest payable on a 2-year bank loan (interest is paid quarterly.)

(e)Made a year-end adjusting entry to amortize a portion of the discount on long-term bonds payable.

Indicate the immediate effects of each transaction or adjusting entry upon the financial measurements in the five column headings listed below.Use the code letters,I for increase,D for decrease,and NE for no effect.

Correct Answer:

Verified

Q132: Payroll-related expenses

Shown below is a summary of

Q133: Accounting terminology

Listed below are nine technical accounting

Q134: Bonds payable-issued between interest dates

Barney Corporation received

Q135: On March 1,2015,five-year bonds are sold for

Q139: Bonds issued at discount or premium

On March

Q140: Notes payable

On September 1,2015,Charles Associates borrowed $600,000

Q141: Operating and capital leases

Berkeley Corporation wants to

Q165: Deferred taxes are classified as:

A)Only a liability.

B)Only

Q182: Bonds issued at par - basic concepts

On

Q183: Bonds payable issued between interest dates -

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents