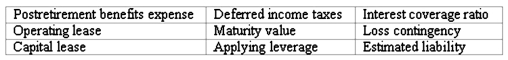

Accounting terminology

Listed below are nine technical accounting terms introduced in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

_____ (a)Operating income divided by annual interest expense.

_____ (b)The amount paid during the current period to retired employees.

_____ (c)A lease agreement that is viewed as equivalent to the lessee purchasing the leased asset.

_____ (d)Using borrowed money to finance business operations.

_____ (e)The risk of a loss occurring in a future period.

_____ (f)A permanent reduction in the amount of income taxes owed which results from the tax deductions for depreciation.

_____ (g)The amount that must be paid to settle a liability at the date it becomes due.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q132: Payroll-related expenses

Shown below is a summary of

Q134: Bonds payable-issued between interest dates

Barney Corporation received

Q135: On March 1,2015,five-year bonds are sold for

Q136: Effects of transactions upon financial measurements

Five events

Q165: Deferred taxes are classified as:

A)Only a liability.

B)Only

Q179: Which of the following is not true

Q182: Bonds issued at par - basic concepts

On

Q183: Bonds payable issued between interest dates -

Q194: Bond prices after issuance

Several years ago,Clear-Air Systems

Q197: Fully amortizing installment notes

When Sue Meadow purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents