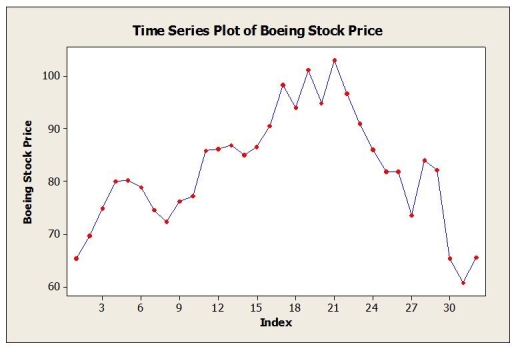

Monthly closing stock prices, adjusted for dividends, were obtained for Boeing Corporation from January 2006 through August 2008 (closing price on the first trading day of the month). The time series graph of these data is shown below.  a. Below are the results of fitting a third-order autoregressive model, AR (3). Write out the model. Are the second and third lagged values significant? Explain.

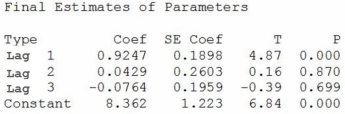

a. Below are the results of fitting a third-order autoregressive model, AR (3). Write out the model. Are the second and third lagged values significant? Explain.  b. Below are the results of fitting a first-order autoregressive model, AR (1). Write out the model. Is this model typical for stock price data? Explain.

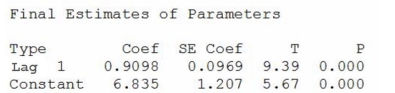

b. Below are the results of fitting a first-order autoregressive model, AR (1). Write out the model. Is this model typical for stock price data? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Annual estimates of the population in the

Q3: The table below shows the actual closing

Q5: A large automobile parts supplier, keeps track

Q5: Consider the following to answer the question(s)

Q7: Consider the following to answer the question(s)

Q8: Quarterly sales data (in $10,000) for a

Q9: The following table shows actual sales values

Q10: Daily closing stock prices for Kyocera Corporation

Q11: Annual estimates of the population in a

Q20: Consider the following to answer the question(s)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents