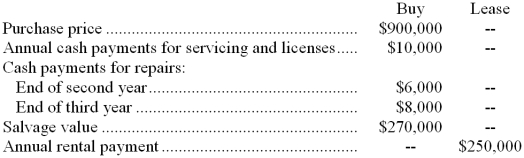

(Ignore income taxes in this problem.) The Wisbley Company is contemplating the purchase of a helicopter for its executives to use in their business trips. This helicopter could be either purchased or leased from the manufacturer. The useful life of the helicopter is four years. Data concerning these two alternatives follow:  If the helicopter is leased, it would be returned to the manufacturer in four years. Wisbley's required rate of return is 22%.

If the helicopter is leased, it would be returned to the manufacturer in four years. Wisbley's required rate of return is 22%.

-The incremental net present value in favor of leasing rather than purchasing is (rounded off to the nearest hundred dollars) :

A) $78,300

B) $65,100

C) $188,100

D) $132,600

Correct Answer:

Verified

Q80: (Ignore income taxes in this problem.) The

Q81: (Ignore income taxes in this problem.) Bleeker

Q82: (Ignore income taxes in this problem.) Eckels

Q84: (Ignore income taxes in this problem.) The

Q85: (Ignore income taxes in this problem.) Stern

Q86: (Ignore income taxes in this problem.) The

Q87: (Ignore income taxes in this problem.) The

Q88: (Ignore income taxes in this problem.) Gimar

Q106: (Ignore income taxes in this problem.) Joetz

Q117: (Ignore income taxes in this problem.) Joetz

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents