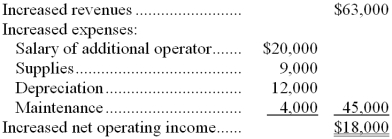

(Ignore income taxes in this problem.) Ferris Company has an old machine that is fully depreciated but has a current salvage value of $5,000. The company wants to purchase a new machine which would cost $60,000 and have a 5-year useful life and zero salvage value. Expected changes in annual revenues and expenses if the new machine is purchased are:

Required:

a. Compute the payback period on the new equipment.

b. Compute the simple rate of return on the new equipment.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q128: (Ignore income taxes in this problem.) Grimmett

Q129: (Ignore income taxes in this problem.) The

Q130: (Ignore income taxes in this problem.) Varnes

Q131: (Ignore income taxes in this problem.) The

Q132: (Ignore income taxes in this problem.) Mcniel

Q133: (Ignore income taxes in this problem.) Sloman

Q134: (Ignore income taxes in this problem.) The

Q135: (Ignore income taxes in this problem.) The

Q136: (Ignore income taxes in this problem.) Romas

Q137: (Ignore income taxes in this problem.) The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents