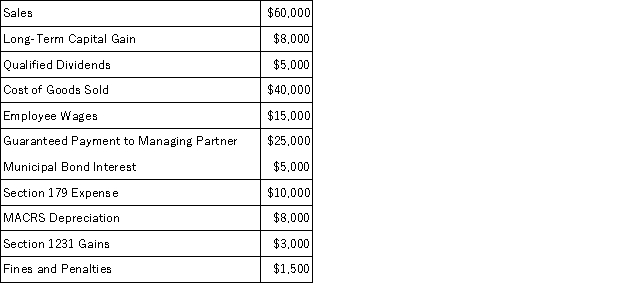

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: On April 18, 20X8, Robert sold his

Q86: On June 12, 20X9, Kevin, Chris, and

Q92: Lincoln, Inc., Washington, Inc., and Adams, Inc.

Q95: On January 1, 20X9, Mr. Blue and

Q97: Ruby's tax basis in her partnership interest

Q101: Fred has a 45% profits interest and

Q102: Clint noticed that the Schedule K-1 he

Q104: Peter, Matt, Priscilla, and Mary began the

Q121: Explain why partners must increase their tax

Q123: What is the difference between a partner's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents