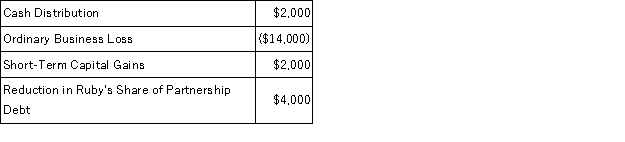

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at risk amount are equal and that she is a material participant in the partnership's activities.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: On April 18, 20X8, Robert sold his

Q86: On June 12, 20X9, Kevin, Chris, and

Q92: Lincoln, Inc., Washington, Inc., and Adams, Inc.

Q95: On January 1, 20X9, Mr. Blue and

Q98: Illuminating Light Partnership had the following revenues,

Q101: Fred has a 45% profits interest and

Q102: Clint noticed that the Schedule K-1 he

Q104: Peter, Matt, Priscilla, and Mary began the

Q121: Explain why partners must increase their tax

Q123: What is the difference between a partner's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents